#48 Charles Schwab: lessons and losses

Charles Schwab isn’t the Amazon of banking, it is more like an MF Global of 2023

Today we delve into the current situation surrounding Charles Schwab (SCHW). We examine their practices with client funds, the risks associated with held-to-maturity (HTM) securities, and the impact of rising interest rates on their business model.

In light of the current events, we have decided to share some of the internal analyses that we typically conduct internally. Please note that these analyses are not directly related to active positions or our investment style. This post aims to provide valuable insights and stimulate thoughtful discussions among our readers in light of the recent developments in the financial world.

Welcome to Edelweiss Capital Research! If you are new here, join us to receive investment analyses, economic pills, and investing frameworks by subscribing below:

1. The role of Charles Schwab as a broker and a bank

When you place your funds with a broker, you effectively become a creditor to the broker. SCHW, as a broker, is subject to regulation by the SEC and FINRA, and operates outside the Federal Reserve system. In addition to its brokerage services, SCHW also owns a bank that transfers excess customer funds from brokerage accounts to bank accounts overnight. As a result, the funds transferred to the bank accounts receive FDIC insurance, while the remaining amounts in the brokerage accounts do not.

2. The questionable use of client funds by Charles Schwab

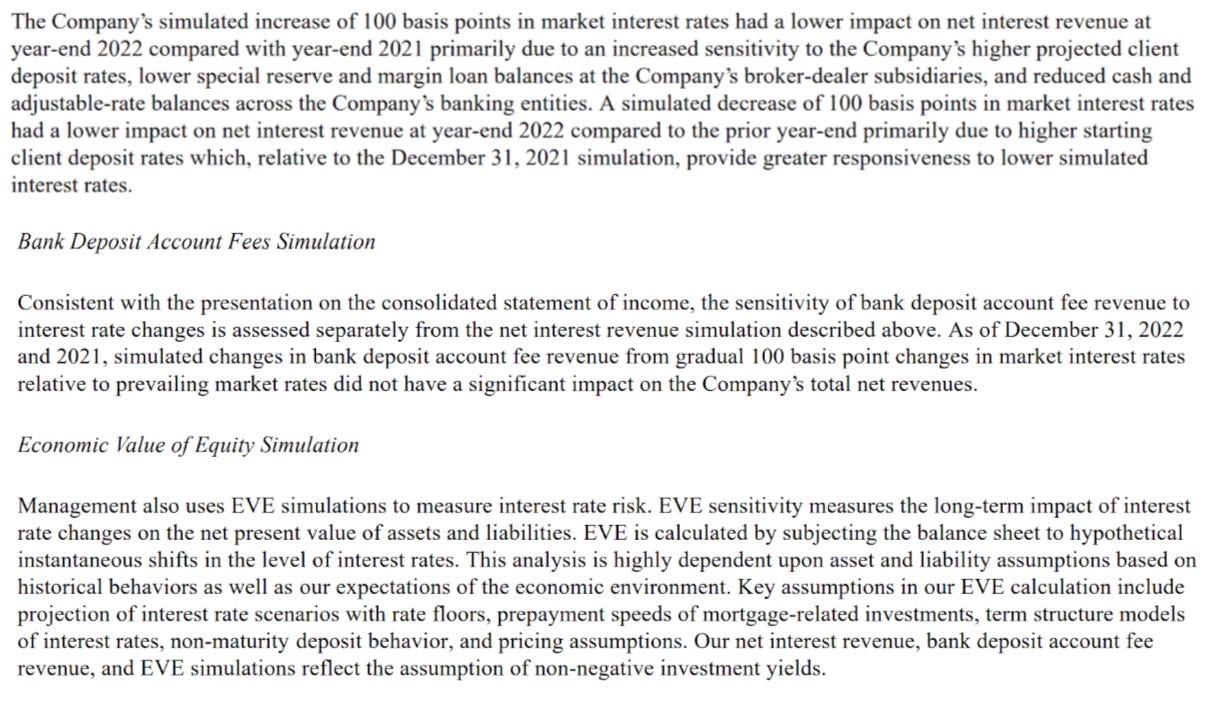

Concerns arise when examining Charles Schwab's management of client funds. SCHW offers customers virtually no interest and subsequently invests in longer-term securities with a modest yield to generate a profit margin. This approach is viable as long as the security prices do not decrease and SCHW is not required to pay significant interest to its customers.

However, the recent sharp increase in interest rates has prompted brokerage clients to reassess their cash earnings. Consequently, SCHW cannot liquidate its long-term securities without causing an immediate insolvency.

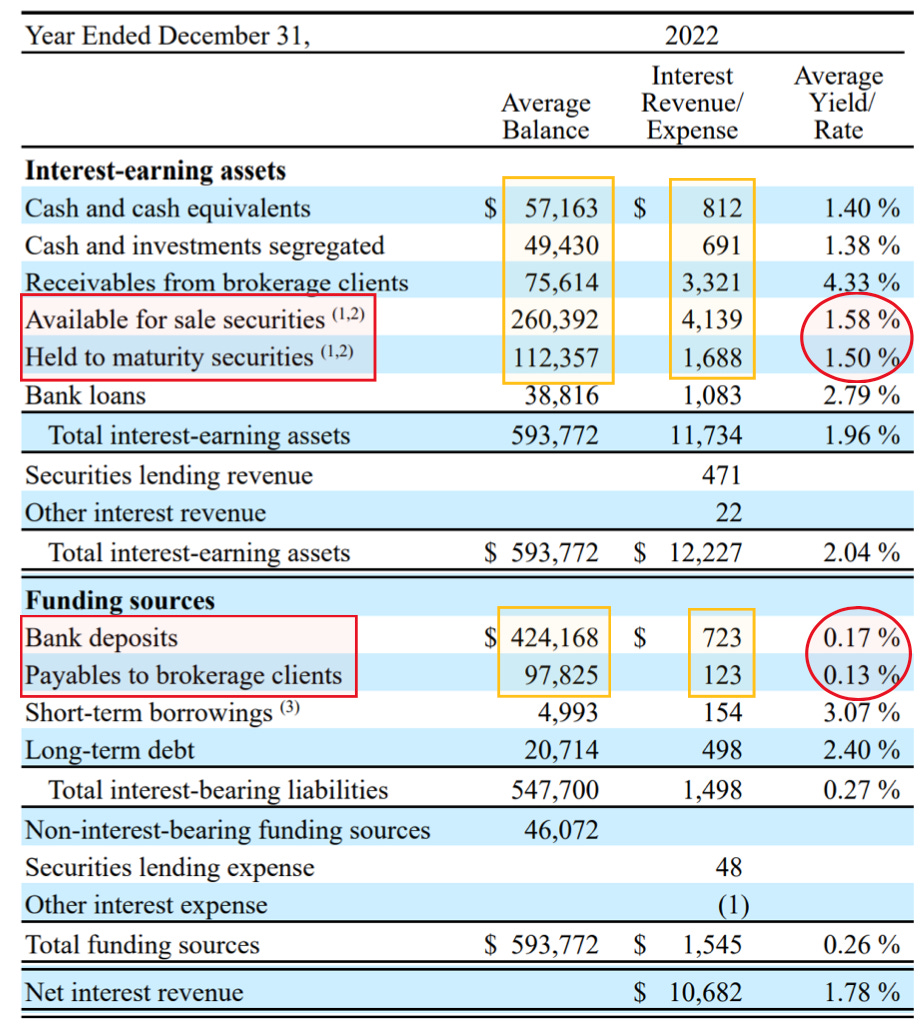

In the figure below, you can see what SCHW pays brokerage clients on their cash versus what they earn. For comparison, Interactive Brokers avoids duration risk entirely by distributing all the cash it earns on holding short-term cash and securities and profiting exclusively through margin lending.

SCHW's emphasis on profiting from duration risk diverges from a broker's primary responsibilities: safeguarding clients' assets and supplying margin to clients.

3. The ticking time bomb: SCHW's long-term securities investments

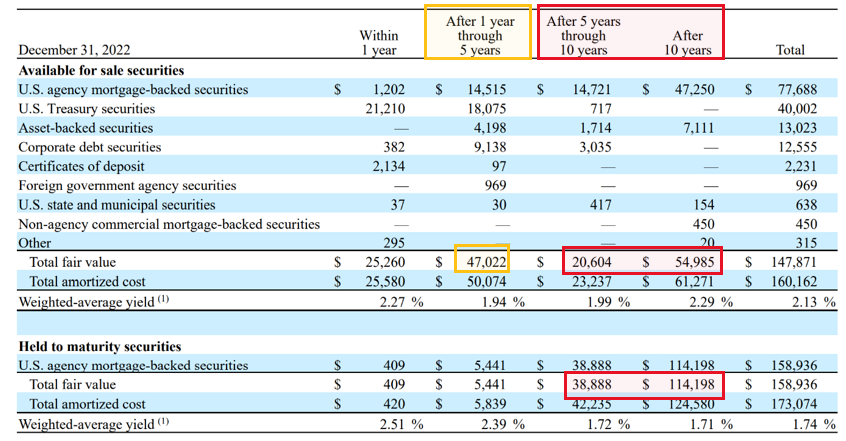

SCHW invested more than $185.9bn in securities that mature in more than 10 years’ time, using overnight customer funds.

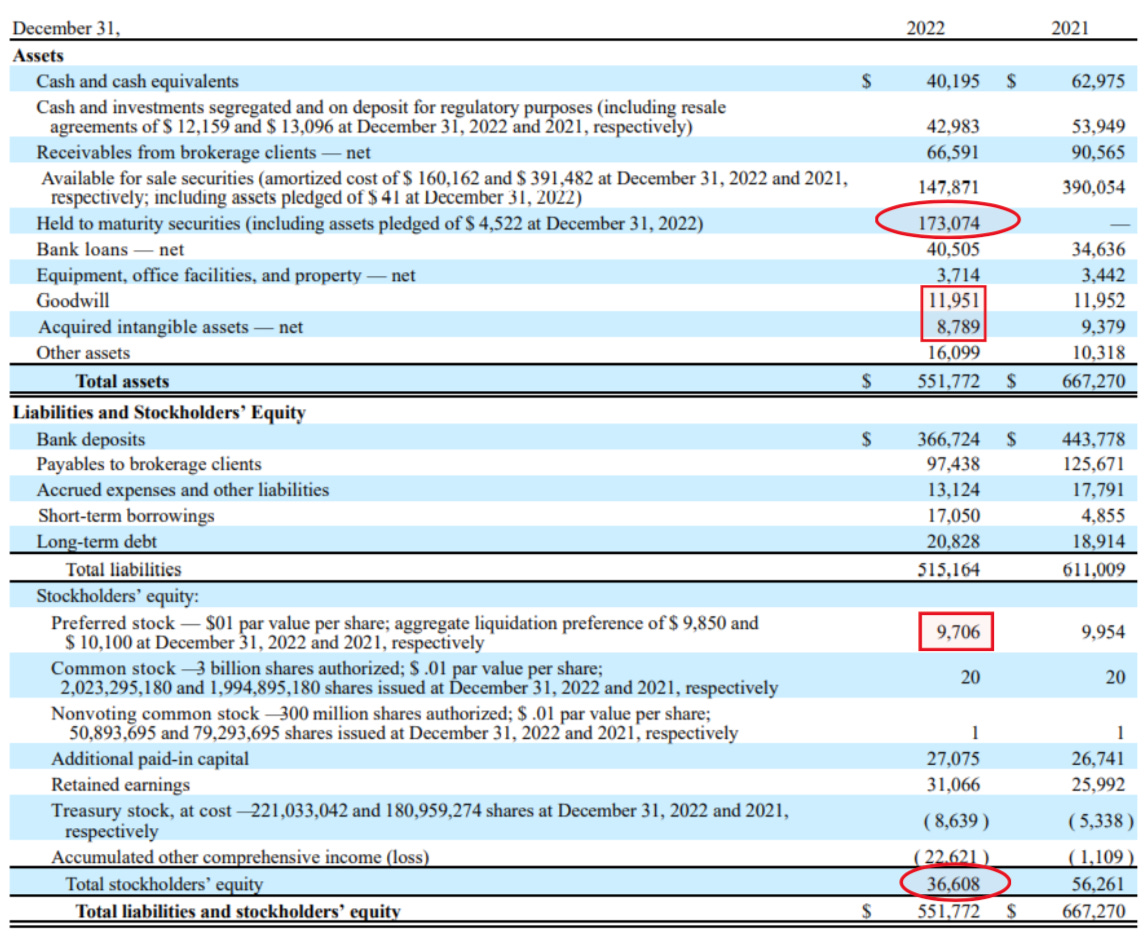

The $173bn of HTM (in orange) are held on the B/S at “amortised cost”, whereas their fair value was only $158.9bn ($14.1bn unrealised loss).

The mark to market value of the tangible Common Equity of SCHW is therefore:

36.6bn “stockholders’ equity”

- 9.7bn in preferred stock

- 20.7bn goodwill & intangibles

- 14.1bn unrealised HTM losses

= NEGATIVE $7.9bn in mark to market tangible common equity

Before Silicon Valley Bank's collapse, SIVB had a negative $3.3 billion in common equity. SCHW is among the rare US financial institutions with negative MTM equity, and it is worth noting that two such institutions have already failed. This situation highlights the potential risks and challenges associated with negative equity in the financial sector.

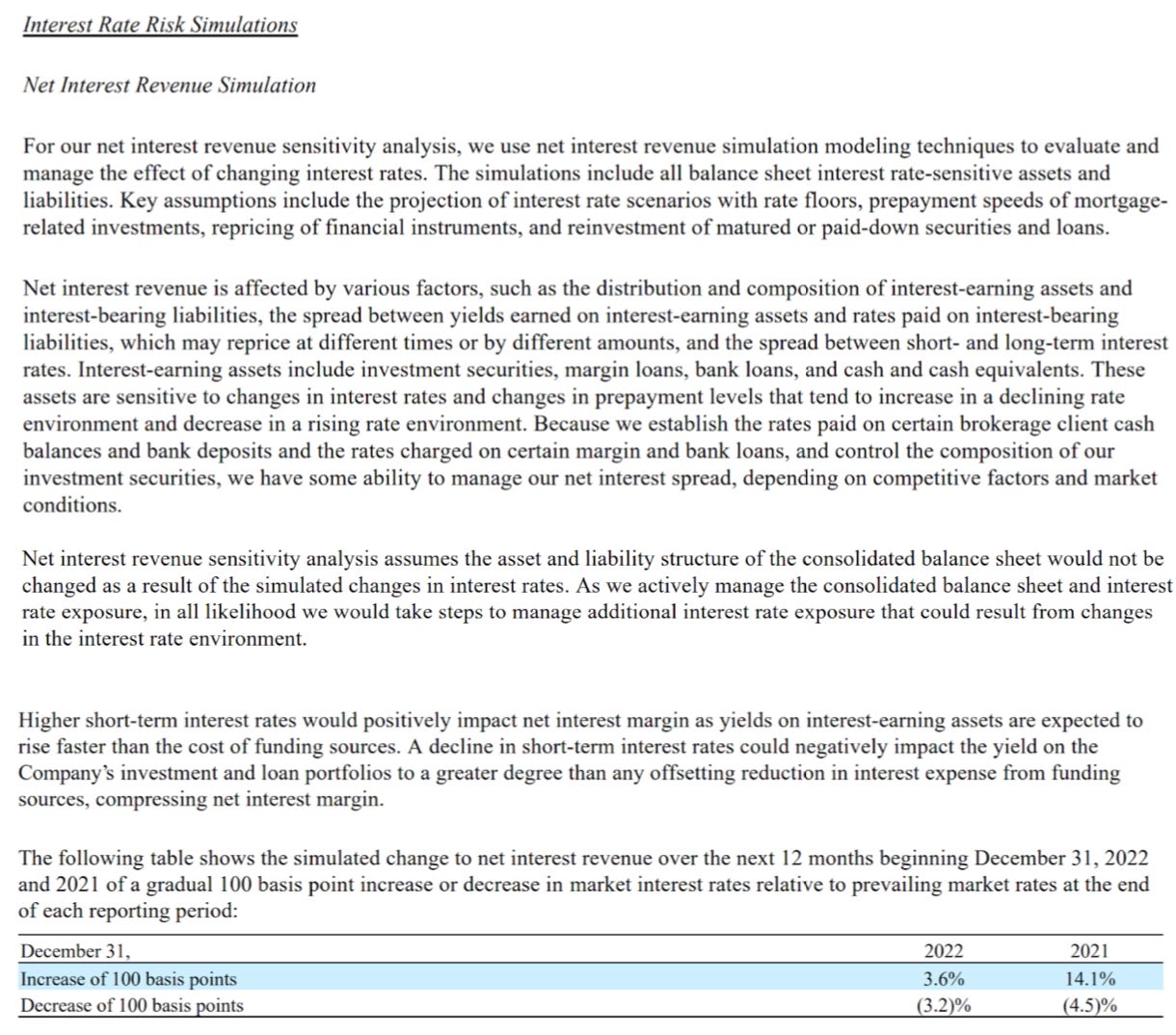

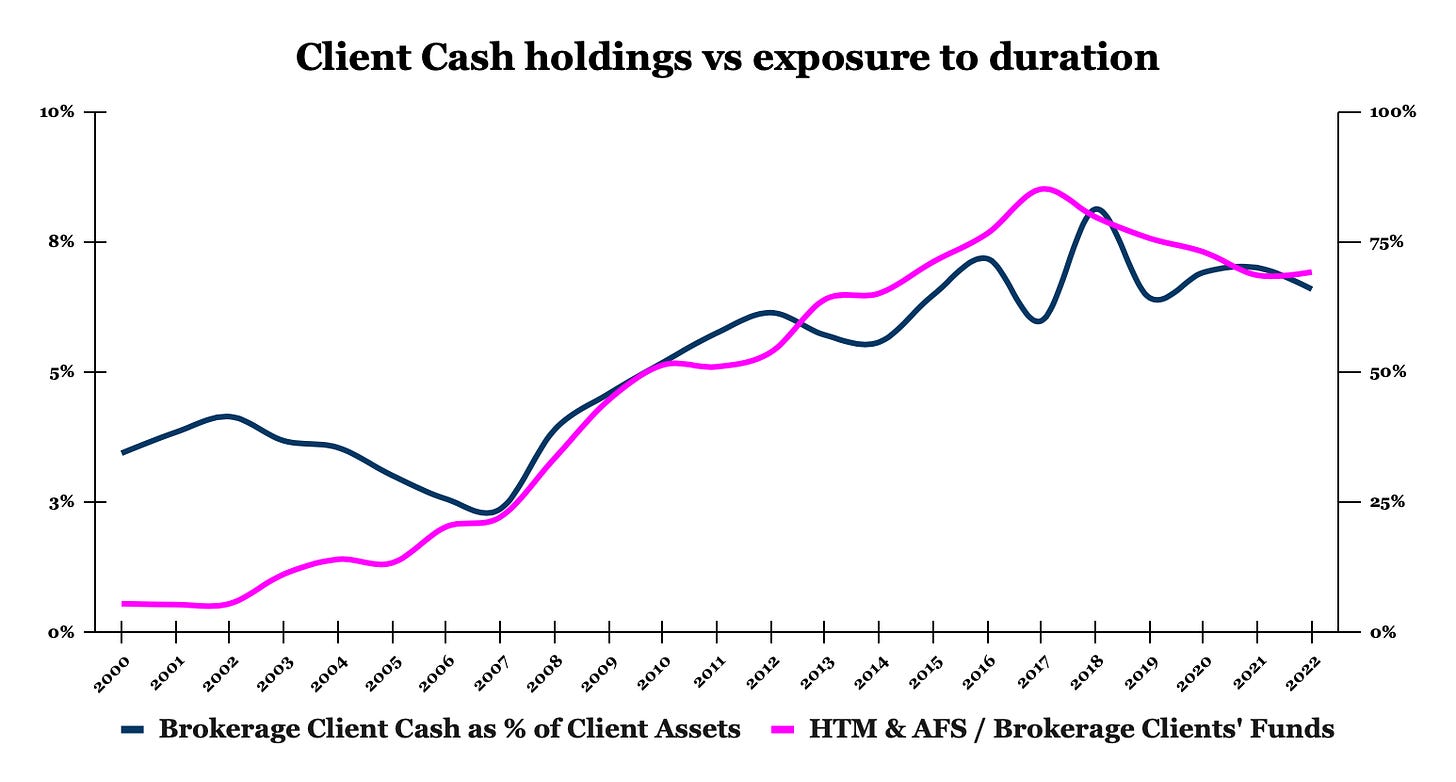

You would have thought that, given the very substantial duration risks, that SCHW would hedge these interest rate risks and explain the risks they are taking to their shareholders. This is what management had to say on the topic:

4. Interactive Brokers: a safer approach

In contrast, consider Interactive Brokers (IBKR), which boasts $11.6 billion in tangible common equity, no exposure to duration risk, and no mark-to-market losses. Furthermore, IBKR holds $102.5 billion in liquid assets compared to $93 billion in customer receivables. Not only does IBKR's balance sheet starkly differ from SCHW's, but the company also shares most of the interest earned on their short-term assets with their customers. This approach demonstrates a more client-centric and financially secure strategy.

5. The uncertain future of Charles Schwab

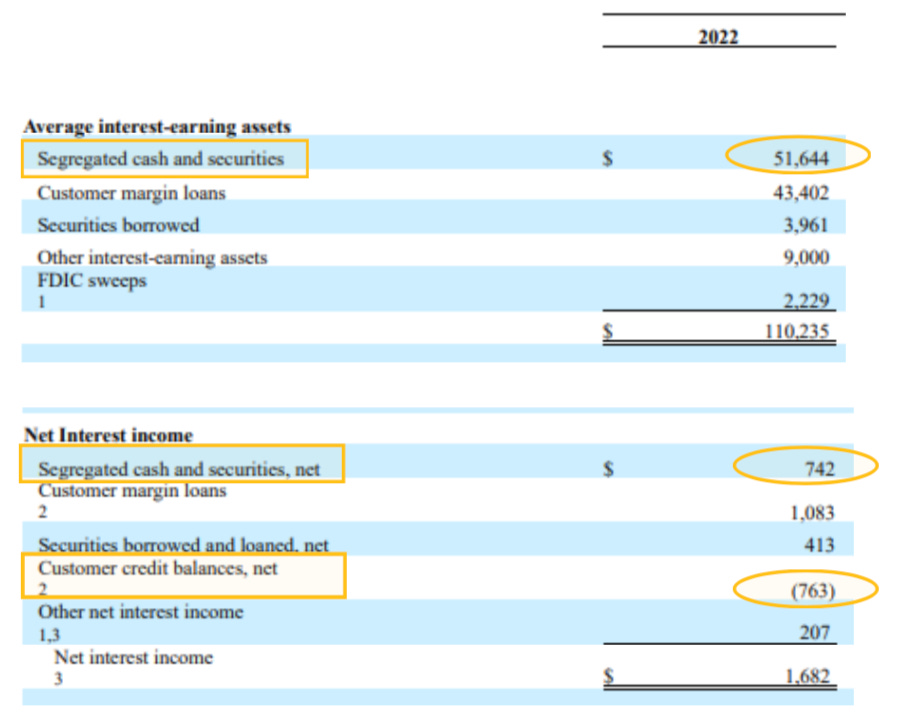

SCHW didn’t get into this problem overnight. It appears to be a direct consequence of the Federal Reserve's suppression of interest rates following the Global Financial Crisis (GFC). In the post-GFC period, the proportion of assets held in cash by SCHW clients increased from less than 3% to a peak of 8%. Concurrently, SCHW significantly expanded its allocation of customer funds to held-to-maturity (HTM) and available-for-sale (AFS) securities, growing from 20% to over 80% at its highest point.

This strategy proved successful as long-term interest rates declined, as demonstrated by the 30-year US mortgage bond interest rates. During favorable conditions, SCHW generated substantial additional revenue in interest rates and capital gains, which it retained for itself.

SCHW continued to purchase increasingly longer-term securities, with the company's retained earnings peaking at approximately $25 billion in late 2021. However, since then, SCHW has experienced substantial losses. On a mark-to-market basis, the company lost around $40 billion pre-tax during the highlighted in red period, which is $15 billion more than it generated throughout its entire operating history. This significant loss underscores the potential risks associated with the company's strategy of investing heavily in long-term securities.

It's important to note that these losses are not recognized in the regulatory capital, as these securities are highly likely to be repaid at par when they mature. Thus, as long as SCHW isn't forced to sell these securities, they don't need to book the loss.

However, this doesn't guarantee smooth sailing. The outcome will depend on future interest rates (both long and short-term) and customer preferences for their cash holdings. Over the past three quarters, customers have been reducing their balances at SCHW by 6-9% each quarter. At its peak in Q1 2022, SCHW held $591 billion in customer funds, either deposited or in brokerage accounts. By the end of Q4, this figure had already dropped to $464 billion. With interest rates now above 4%, this trend is likely to accelerate, as it is in customers' best interest to reduce cash holdings by, for example, investing in money market funds or switching to brokers offering higher interest rates. It's no coincidence that IBKR is aggressively advertising their 4% interest rate and has continued to grow customer deposits during this time.

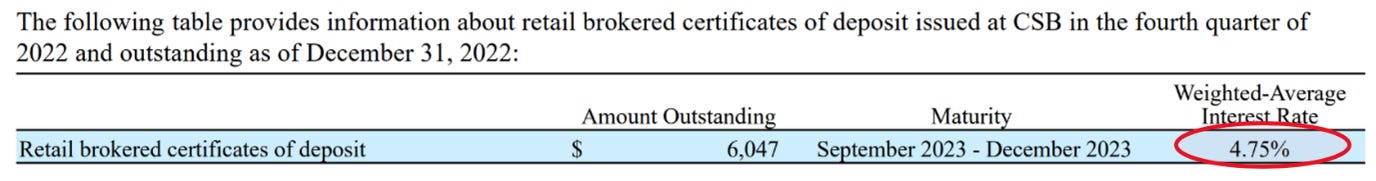

SCHW finds itself in a difficult position – losing customer funds and facing the risk of tapping into AFS and HTM securities, which could trigger losses that breach their regulatory capital requirements, or funding lost deposits at higher rates. SCHW already has to pay more than 4% on certificates of deposit (CDs), and accessing the Federal Reserve's facilities would also cost them over 4%.

With the average yield on their long-term securities at less than 2.2%, each $10 billion in lost deposits will cost SCHW a minimum of $200 million in lost earnings. If customers decrease their cash holdings with SCHW to pre-GFC levels (around 3%), earnings would be reduced by $5 billion ($250 billion in lost deposits x 2% lost interest/negative funding spread). With peak pre-tax earnings at around $9 billion annualized, earnings would be halved and remain at that level until either interest rates significantly decline or the long-term securities portfolio is repaid over the coming decade. In the meantime, SCHW shareholders will continue to bear the risk of inflation reminiscent of the 1970s further devaluing long-term bonds (not a prediction, just an observation).

Considering current interest rates and the assumption that deposits will keep moving to higher interest rate products, SCHW's earnings power could be as low as $2 billion for a stock that recently traded at a market cap exceeding $100 billion. In such a scenario, dividends should not be expected. Instead, SCHW may need to raise equity to strengthen their balance sheet.

This is what the CEO has said in the last few hours. Apparently, everyone is entitled to their own opinion on the matter.

6. The irony and potential scandal in Charles Schwab's dual role

The irony of this situation is that if SCHW operated solely as a broker, they might have already experienced a bank run, as depositors would be concerned for their money. This occurred with MF Global in October 2011 when they took leveraged positions on European government bonds. Ironically, these bets would have ultimately been profitable, but the company faced a run on deposits when they announced the unrealized losses.

One could argue that the real scandal lies in the fact that SCHW is allowed to sweep funds into a bank every night, make substantial bets on long-term interest rates, and still benefit from FDIC insurance.

If you enjoyed this piece, please give it a like and share!

Thanks for reading Edelweiss Capital Research! Subscribe for free to receive new posts and support our work.

If you want to stay in touch with more frequent economic/investing-related content, give us a follow on Twitter @Edelweiss_Cap. We are happy to receive suggestions on how we can improve our work.

Extra

A poem by ChatGPT-4 on the risks of HTM securities for shareholders:

In this tale of banks and securities unbound, A warning for shareholders, now we expound. For HTM securities, stable and steady, Can still bring risks, for which to be ready. As interest rates rise and bond prices descend, The hidden losses start to portend. Banks feel the pressure, capital wanes, Liquidity tightens, uncertainty reigns. Should banks falter and the crisis unfold, Shareholders witness their fortunes untold. With capital shrinking and losses now real, Their stock prices suffer, a heartbreaking ordeal. The value they held, once soaring high, Now plummets to earth, as investors sigh. Dividends vanish, the future unclear, The once-promising banks, now shrouded in fear. So, shareholders, listen, and take heed of this rhyme, In the world of finance, there's danger to find. Though HTM securities appear safe and sound, Their hidden risks can still bring a bank down.

Great take, thank you, quite a difference between Schwab & IBKR ... ref potential further downside for Schwab, trust is a fragile thing ... though the FED's new BTFP program on top of the FHLB should help to mitigate liquidity/funding issues for now, hence lessen the need to sell their securities at a loss, at least for now ... will be nice to follow this case in any case :). Have a great day !

Very interesting to read, especially after I saw Schwab taunted as a fat-pitch Buffett-like generational buying opportunity at current prices...