#47 The impact of the Bank Term Funding Program on US banks

A complete overview of US Banks' equity positions as of Dec 2022

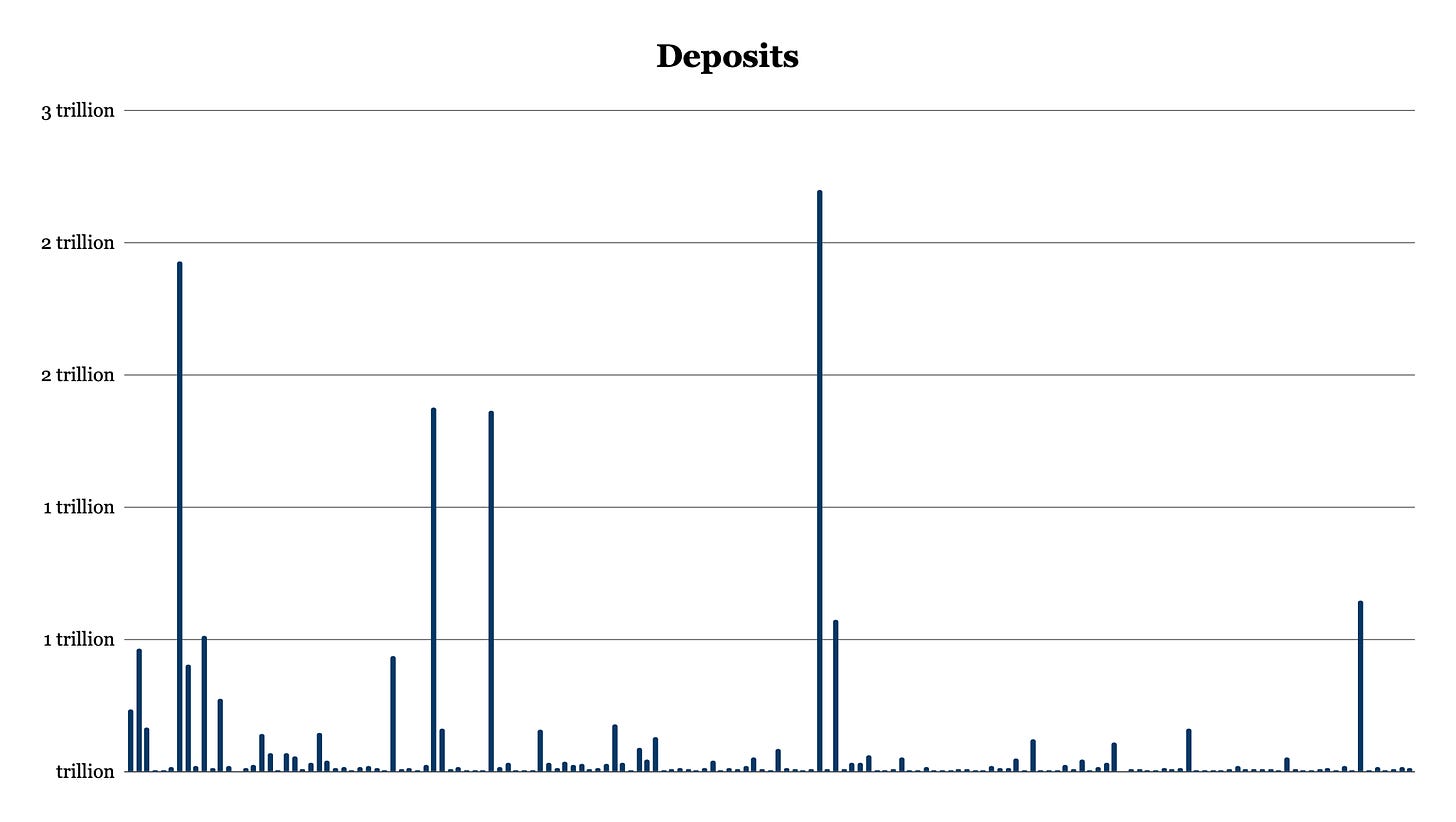

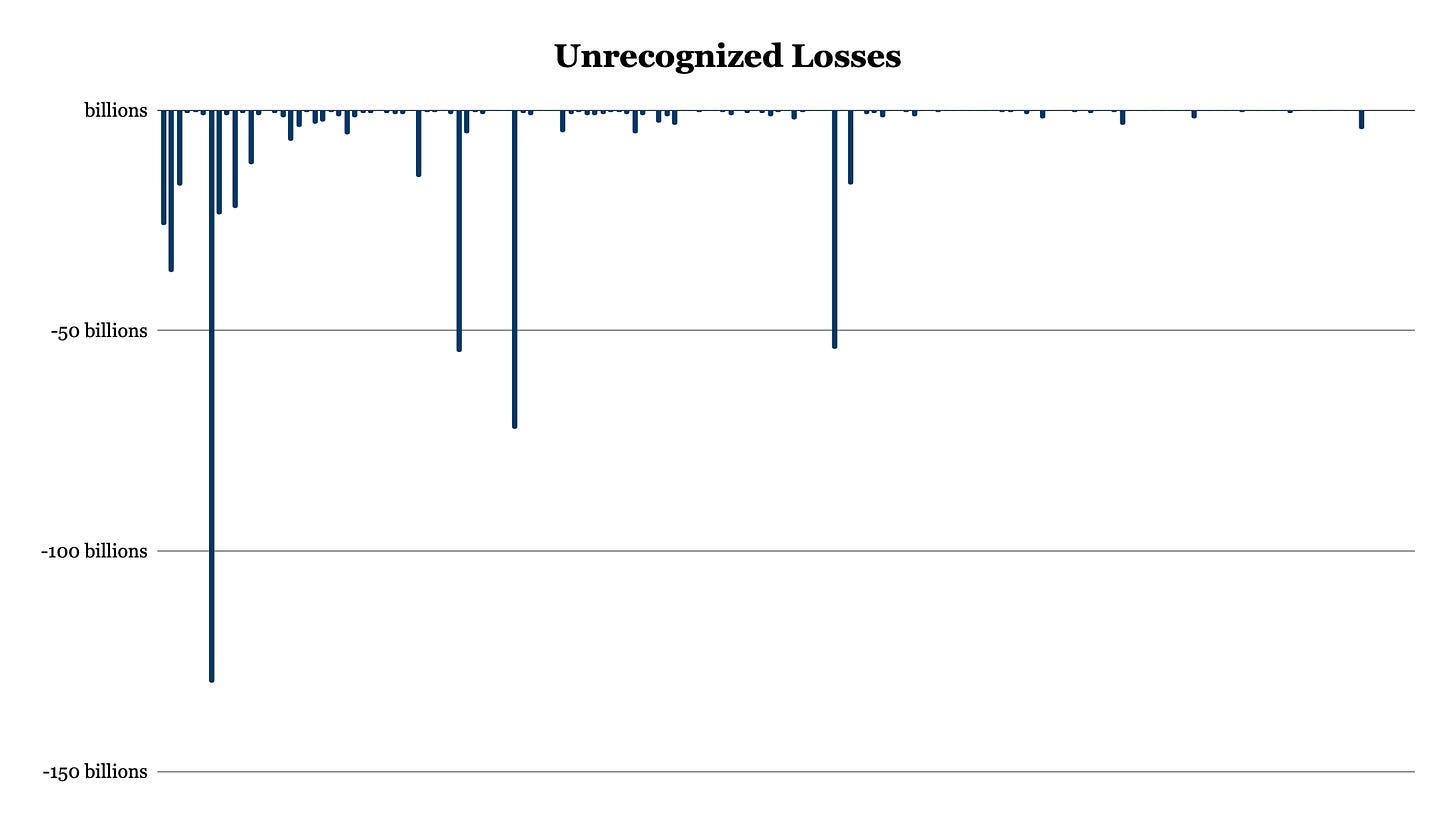

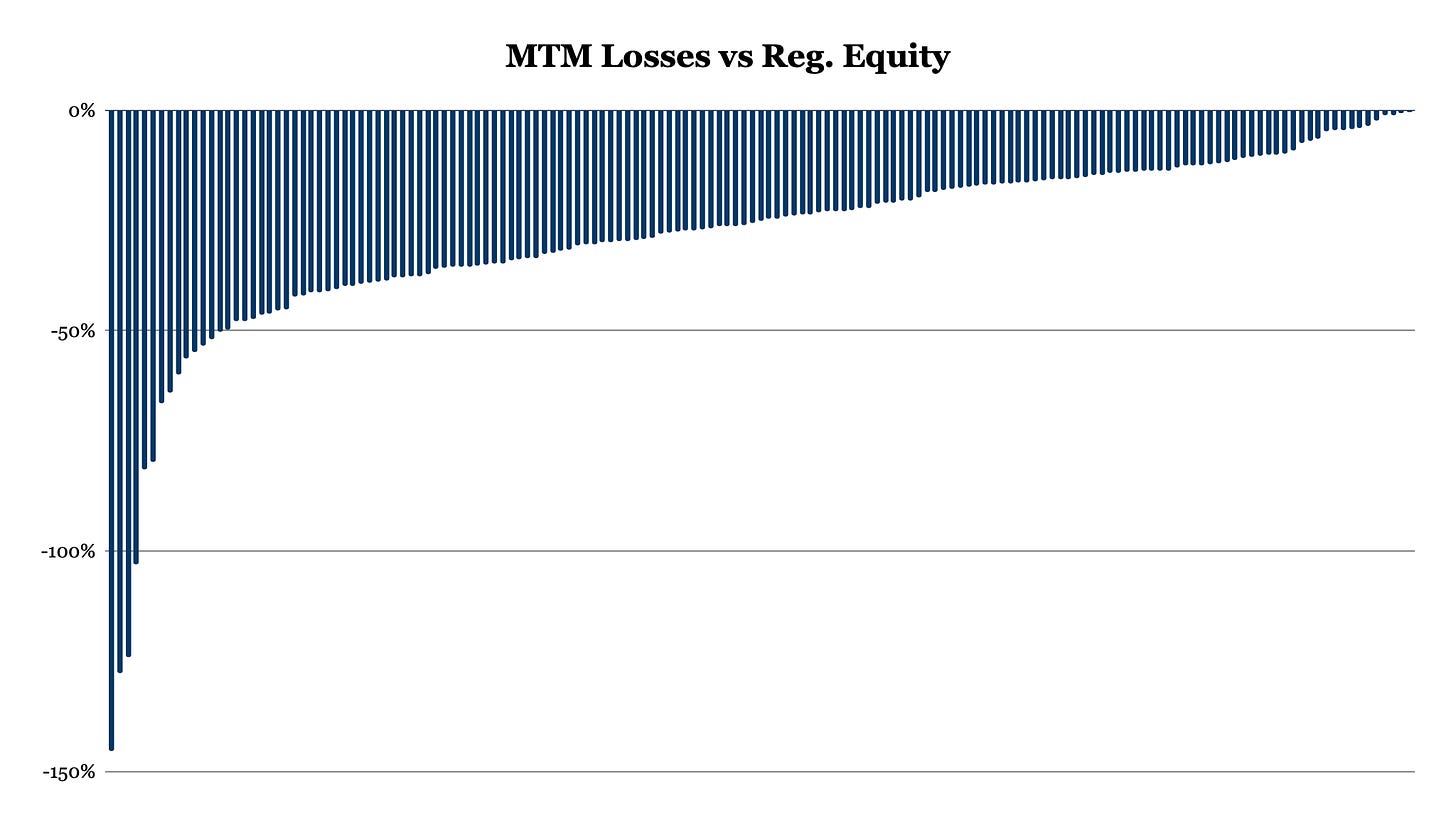

The following post is the result of a weekend's work compiling the position of the US financial system with the latest fillings published as of December 31, 2022. Out of the 157 banks analyzed, we have found six financial institutions with negative or almost negative mark-to-market equity. The objective of the article is to show the result of our research, avoiding any sensationalism and just stating the facts.

We typically avoid immediate news due to its short-term focus. However, due to the significance of the situation and its potential ramifications, we consider it is important to take a direct and comprehensive look at the current state of affairs.

Welcome to Edelweiss Capital Research! If you are new here, join us to receive investment analyses, economic pills, and investing frameworks by subscribing below:

The new Bank Term Funding Program (BTFP) made available by the Fed, offers an alternative for financial institutions to replenish lost deposits with new funding. However, it does not address the fundamental challenge confronting banks, which is their exposure to longer-term fixed-rate securities exceeding $4.7 trillion that generate lower yields than the BTFP. Consequently, availing of this funding mechanism would result in a negative interest carry for the banks. It does, however, avoid the need to realize losses on these securities.

The recent collapse of SVB, and the accelerated bank run that followed, highlight the vulnerability of banks facing unrecognized mark-to-market (MTM) losses. Although the BTFP could have prevented the run on the bank, it would have resulted in SVB being unprofitable for years to come, making it unlikely that the program could have saved SVB shareholders.

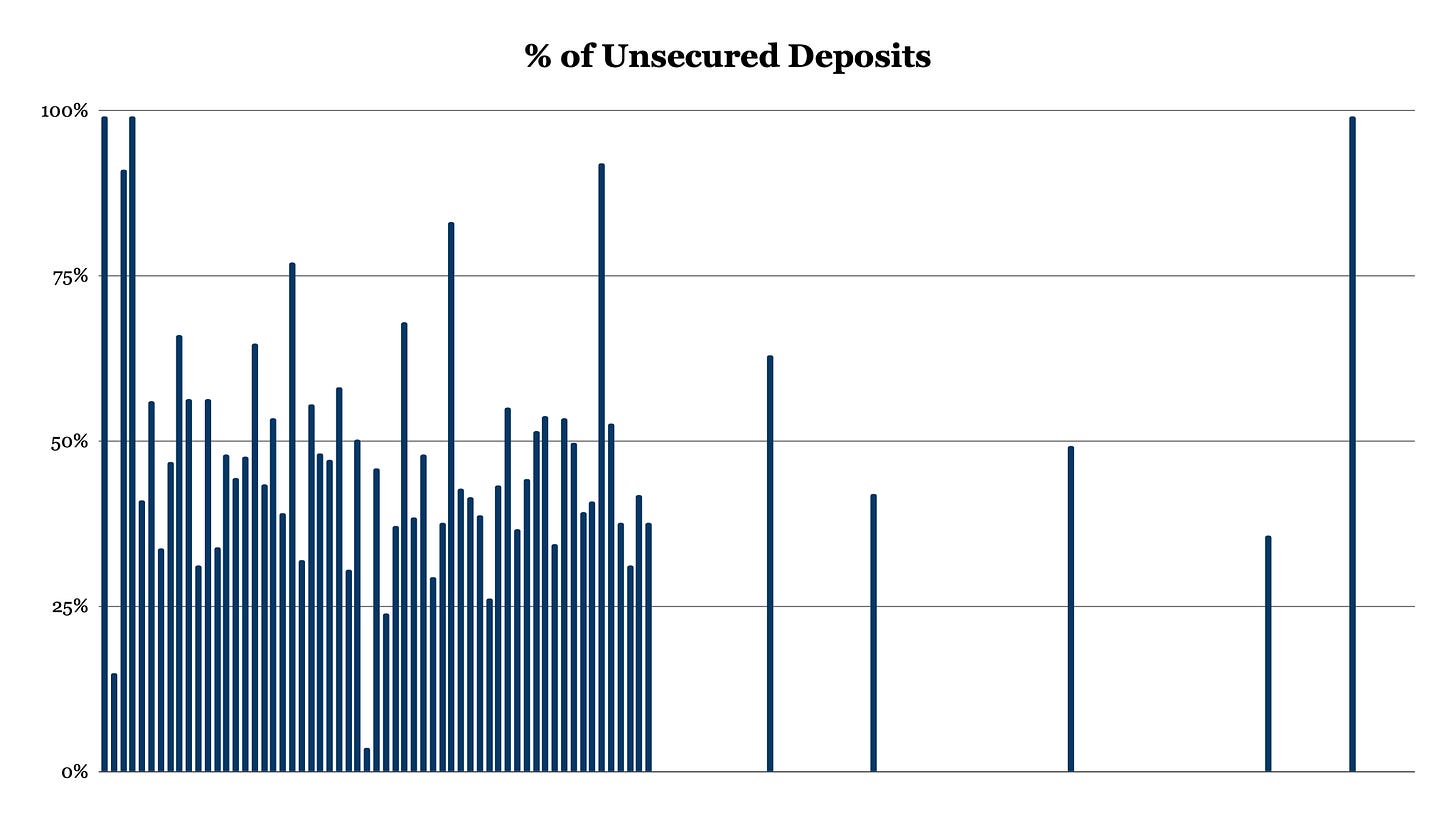

SVB and Silvergate are not the only banks facing negative mark-to-market equity, as of December 2022, only State Street and Charles Schwab were in a similar position. Banks with unrecognized MTM losses exceeding 30% of their regulatory equity have a total shortfall of approximately $445 billion if losses were realized. These banks have deposits of $9 trillion, of which about $4.2 trillion are uninsured.

For all the figures, each line represents one of the 157 banks analyzed, organized left to right by MTM Losses/Reg. Equity.

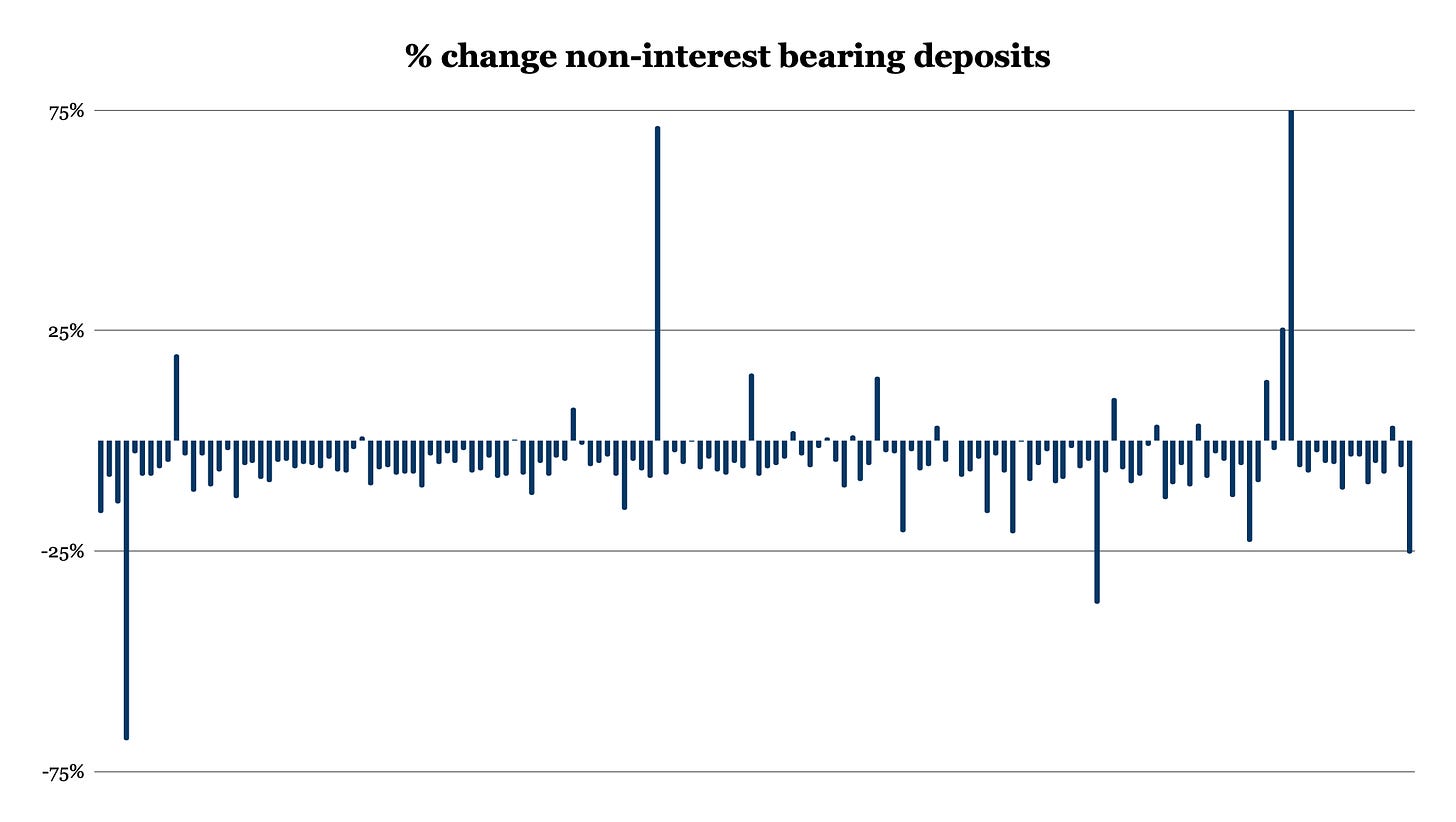

To add to the already precarious situation, banks have been losing over $300 billion a quarter in non-interest deposits, which could reduce net interest income by over $40 billion on an annualized basis. In the absence of any counter-effects, this could reduce net interest income for banks by approximately 10% per annum and net income by around 20% per annum. Furthermore, as interest-bearing deposits mature, interest income is further eroded, and as long as banks have a duration mismatch, this will continue to reduce net interest income. The banking sector faces significant challenges, and it remains to be seen how banks will adapt to these changing market conditions.

US bank accounting

US banks can elect to hold securities in three ways:

Securities for Trading (which have their gains and losses immediately accounted for through the Income Statement)

Available for Sale (AFS)

Held to Maturity (HTM).

Importantly, in both cases, unrealized gains or losses are not recognized in the regulatory calculations for Common Equity unless they are sold in whole or in part. As soon as a pool of HTM is sold, all the gains and losses within that pool are recognized. AFS securities are included in the Accumulated Other Comprehensive Income (AOCI) and are deducted from the book value of the Common Equity in the balance sheet (B/S). Any gains and losses in HTM are not recognized on the B/S, but are disclosed in the text of the footnotes.

In effect, mark-to-market losses for HTM and AFS do not affect Regulatory Capital, unless losses are deemed to be no longer temporary. The effect is similar to how loans are accounted for – they are not MTM, unless there is some kind of impairment, like a potential credit loss.

During the Savings and Loans (S&L) crisis in the early 1990s, there were banks with negative liquidation values, as loans were underwater. Banks can remain solvent from a regulatory perspective, despite having negative liquidation value, based on the market values of the assets. It ultimately depends on how the regulator deals with these issues and whether the banks will be provided with liquidity to cover transfer requests.

The BTFP now allows banks to borrow 100% of the par value of AFS and HTM at 10bp above the overnight rate. While this means they don’t have to sell the securities (and losses remain unrealized), the cost of the facility is higher than the average yield of those securities, so banks would only make use of this facility in case their customer deposits drop significantly.

The scale of unrealized losses at US banks

We have collected the information for all banks included in the S&P Bank ETF, S&P Regional Bank ETF, as well as certain financial large institutions that are not included in those ETFs (e.g. State Street, Charles Schwab, GS, MS) to build a complete overview of equity positions as of Dec 2022.

There are six financial institutions with negative or almost negative mark-to-market Equity: State Street, Charles Schwab, SVB, Silvergate, as well as two other regional banks. This report does not name regional banks that haven’t gone under, as we do not want to suggest that these banks are at risk of insolvency or that depositors should take their money out of these banks specifically.

NB since the BTFP doesn’t offer a solution to banks with a high loan-to-deposit ratio, bank runs can still occur to the extent that they drain the available liquidity including funds available through BTFP, as well as other programs available for these banks, such as the FHLB System.

Bank runs are not rational for depositors with less than $250k in deposits, as they will receive the funds back from the FDIC in case a bank is shut down. The risk of bank runs should be concentrated in banks with uninsured deposits, or where there is a heavy reliance on non-interest bearing deposits, where depositors could be looking to move their funds to money market or savings accounts with higher rates of interest due to the rapid rise in short-term interest rates.

SVB had about 90% uninsured deposits, Silvergate close to 100% and Signature Bank was also above 90%. No other regional bank has such high levels of uninsured deposits. The next two highest are at 75% and 68% respectively. Typically a regional bank has around 40-50% of its deposits above the $250k FDIC threshold. That means for the typical regional bank, if half of their uninsured deposits were to leave, they would lose 25% of their deposits. About half of all banks have more than this amount of cash and securities on hand.

Silvergate and Signature Bank had exposure to crypto deposits, which were rapidly shrinking. SVB’s problems resulted from a mismatch of their cash-flow from maturing securities and the run off from deposits, partly the result of their clients’ cash burn and lack of inflow from new investments. In the last quarter of 2022, SVB had the third-largest decline in deposits of all banks. As they had to dip into AFS, they needed to recognize losses and once the bank run started they had to dip into HTM, which meant that at that point the bank would have to recognize the mark-to-market losses and no longer have sufficient regulatory capital.

While deposits for the banking system overall shrank only 1% in Q4 2022, the deposit losses were not evenly spread out, with about 60 banks experiencing significantly higher deposit outflows. Worse, non-interest deposits shrunk 6% in Q4 2022 and only 10% of banks managed to increase their non-interest deposits during that period.

What happens next?

Assuming no further bank runs, financial institutions that rely heavily on non-interest-bearing deposits to fund longer-term loans are vulnerable to seeing depositors move to higher interest-paying accounts or money market funds.

Of the large financials, Schwab and State Street are particularly exposed. Neither of them can afford to sell their AFS or HTM without triggering huge losses. If customers move funds they will be forced to refinance at rates substantially above the interest they earn from the securities holdings.

Second-order effects of shrinking deposits and HTM and AFS not being able to liquidate without triggering losses, are going to be a crunch on new loan growth. Banks may prefer to de-risk by making fewer new loans and reducing the risk profile of their loans. However, they are unlikely to allocate to long-term securities as the BTFP applies only to securities that were already on the books prior to the facility being announced.

It is also likely that banks with large MTM losses are going to preserve capital by cutting or eliminating dividends and potentially raising fresh equity capital.

If you enjoyed this piece, please give it a like and share!

Thanks for reading Edelweiss Capital Research! Subscribe for free to receive new posts and support our work.

If you want to stay in touch with more frequent economic/investing-related content, give us a follow on Twitter @Edelweiss_Cap. We are happy to receive suggestions on how we can improve our work.

References

NB all numbers in this report are as of Dec 2022 and cover the universe of banks included in this report (unless otherwise stated). Some figures were estimated, but otherwise are from the banks’ SEC filings and CapitalIQ.

great take, thank you!